ATTENTION: BUSINESS OWNERS WITH A 550+ CREDIT SCORE

Discover how to secure at least

$100,000 in business funding in less than 72 hours

Over $100M Funded to 5,000+ Businesses of All Sizes & You Will Be Next!

MINIMUM REQUIREMENTS FOR AUTOMATIC APPROVAL

3 MONTHS

Recent Business Bank Statements

550+

Personal FICO SCORE

8 MONTHS

Minimum Time in Business

$5,000+

Business Monthly Revenue

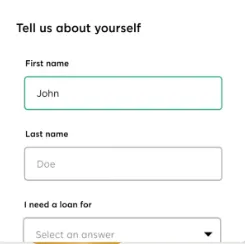

HERE IS THE PROCESS TO GET FUNDED

Step 1. Complete The Application

Simple Online Application Which You Can Complete Within Minutes. This Will Not Affect Your Credit Score.

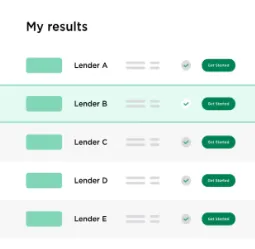

Step 2. Get A Decision

We Will Send You Offers After We Review Your Submitted Application Within 24 Hours.

Step 3. Receive Your Funds

Once You Have Accepted Your Offer, Funds Will Be Sent Directly To Your Account Within 24 Hours.

IT'S TIME TO THRIVE & TAKE YOUR COMPANY TO THE NEXT LEVEL

GET BUSINESS FUNDING IN LESS THAN 72 HOURS

Our financial lending solutions are designed to help you achieve your dreams with ease and confidence. We offer tailored options to meet your needs. With fast approvals, competitive rates, and flexible repayment plans, you can trust us to be your partner in financial success. Take the next step towards your goals with a lending solution that works for you.

Fast Approval Process – Experience swift processing and receive your funding faster, ensuring no delays in reaching your financial goals.

Tailored Lending Plans – Our flexible loan options are crafted specifically for your needs, making sure you get the most suitable financial solution.

Flexible Repayment Terms – Choose a repayment schedule that aligns with your income, allowing you to manage your finances with ease and comfort.

Competitive Interest Rates – Benefit from some of the most competitive rates available, ensuring you save money over the life of your loan.

Dedicated Support – Our team of experts is available to guide you every step of the way, offering personalized assistance to ensure a smooth lending experience.

Frequently Asked Questions

What types of loans do you offer, and how do I know which one is right for me?

We offer a wide variety of funding options, including Business Credit Card stacking, Business lines of credit, SBA Loans and grants. Each designed to meet different financial needs. Our team works closely with you to understand your situation, ensuring we recommend the most suitable loan type that fits your goals. We take a personalized approach to guide you toward the best option.

How quickly can I get approved for a loan, and what is the process like?

Our approval process is designed to be fast and efficient, typically taking only a few business days to process your application. After submitting your required documents, our team will assess your eligibility based on your financial history and lending needs. We ensure you are kept informed throughout the process, and once approved, you’ll receive the funds quickly so you can proceed with your plans without delay.

How do your interest rates compare to other lending institutions, and are they fixed or variable?

We pride ourselves on offering competitive interest rates that are often lower than those available from other lenders. Our rates are transparent, and whether fixed or variable, we make sure you fully understand the terms before proceeding. Fixed rates provide stability, ensuring your payments remain consistent throughout the term of the loan, while variable rates can offer flexibility, adjusting to market conditions as needed. Our team will help you determine which option suits your financial situation best.

How do I apply for a loan, and what documents do I need to provide?

Applying for a loan with us is simple and straightforward. You can apply online through our website or by contacting our team directly. To complete your application, you’ll need to provide basic information, such as proof of identity, income details, and any relevant financial documents. Our team will guide you through the process, making sure all necessary paperwork is submitted correctly and efficiently to ensure a smooth approval process.

Testimonials

I had been struggling to secure funding for my small business, dealing with traditional lenders who couldn't offer the flexibility I needed. When I found this platform, everything changed. The team quickly understood my needs and tailored a loan plan just for my business. The approval was fast, and I received the funds in a few days.

Aidan Harper

As a single mother and homeowner, managing my finances can be overwhelming at times. After a series of unexpected expenses, I needed financial help but wasn’t sure where to turn. That’s when I found this incredible lending service. The process was so easy to understand, and I was impressed by how quickly my loan was approved.

Sophie Alvarez